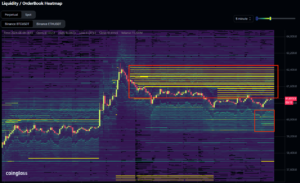

12,000 BTC Sell Order

Recently, the large 12k Bitcoin sell order book on Binance has sparked concerns across the crypto sphere regarding whale manipulation. The bitcoin price slumped again after rising when the $750-million order liquidated in between prices of $61,200 to $62,500 appeared. Market analysts speculated the sell order could be a classic “spoofing” maneuver in which an unconfirmed large number of orders are placed to influence market prices and subsequently canceled.

The Sell Order’s Impact

At present prices of $60.8k, this is a 12,000 BTC sell order like nothing you have seen before, as it is a phenomenon of significant volume pressure. These types of orders create what is known as the “sell wall”; the market will assume that due to the sale, prices will go down, which will increase the selling for smaller players that will assume price pressure and anticipate buying and hence sell at the lowest price possible.

It has been an interesting turn of events that this order has been placed now when Bitcoin prices have been consolidating around the psychological levels of $57,000 and $59,000. This is a zone that has been watched by traders closely due to other traders’ fear that Bitcoin is stagnating and not finding a way around the previous high of $62,775 that was achieved earlier in April.

Whale Manipulation Concerns

Most of the fear being expressed by the market participants is around the risk of whale manipulation where large traders can move the price with their other considerable pockets. The manipulation of such markets is made possible through what traders have implemented and refer to as spoofing.

‘Spoofing’ is defined as the strategic placement of a large in order to make moves in a market that are falsified, and such an order can be canceled before going through.

In this aspect, the whale can make such a big order that will make it appear as though Bitcoin will fall. This will be a bearish Whale Bomb and will trigger other traders into pre-sell actions. These trades will however be canceled at where they are marked and instead bought back at lower prices.

This is not an isolated market occurrence. The historical data would suggest that recent spike in whales moving bitcoin to exchanges is a sign of an impending sell-off, one which could easily exacerbate the price movements. The latest sell order has raised concerns about similar practices, in large part due to the fact that much of the cryptocurrency market is still unregulated when compared with mainstream financial markets.

Divergent Market Sentiments

For some traders, it is being viewed as more of a calm before the storm, and bitcoin could enter into another consolidation pattern where its price range narrows down until there is an explosive move. Yet, other voices are more cautious given how a large sell order both being executed or threatening to hang over the market could lead to an abrupt drop in price.

Additionally, this has led to a war of words among analysts on Bitcoin’s future move. The sell order had sparked speculation that a return to bearish conditions could result, although there are many traders out there who continue to believe in the long-term bullish outlook for Bitcoin as institutional interest continues alongside regulatory frameworks.

The recent return of Bitcoin to its 200-day exponential moving average, a crucial technical indicator in terms of this cryptocurrency, has given some traders hope that the low point may be near.

What’s Next for Bitcoin?

Traders should be alert as the market continues to digest what this sell order actually means. Having an order that large in the book creates a huge amount of uncertainty and makes it very likely for big price swings. Market participants will need to watch this space closely for any changes in the order book balance that suggest a change, or even a developing trend in sentiment.

If this panic-selling continues and those with funds in bitcoin decide to leave the sinking ship, we could well be headed for a bloodbath across markets. If the bearish move plays out completely, expect $35,000-$40,000 for #bitcoin.

Traders are warned to be extra-careful with the price action and monitor market movements closely together with on-chain metrics. Whales and other big players can influence the market to a considerable extent, so it is critical for smaller traders to be well-informed at all times.