In the wake of FTX’s dramatic downfall, Bybit has seized the opportunity to become the world’s second-largest cryptocurrency exchange by trading volume. According to Bloomberg, Bybit, based in Dubai, has experienced remarkable growth, underscoring the resilience of the crypto market and the evolving regulatory environment.

Strategic Growth After FTX Collapse

Bybit’s rise to prominence can be attributed to its strategic targeting of former FTX users and its expanding user base in Europe and Russia. “When FTX collapsed, we saw the opportunity,” remarked Bybit co-founder and CEO Ben Zhou, reflecting on the fall of Sam Bankman-Fried’s once-dominant exchange. This strategic move allowed Bybit to capture a significant portion of the market share that FTX had left behind.

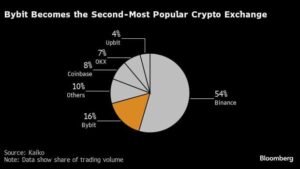

A key factor driving Bybit’s growth is its unique margin trading service, which allows over 160 tokens to be used as collateral. “This was something that no one else had,” Zhou emphasized. This innovative feature has significantly contributed to Bybit’s appeal among traders, offering them more flexibility and options in their trading strategies. Since October, Bybit’s market share has doubled to 16%, enabling it to surpass Coinbase in March, as reported by Kaiko data. Bybit now trails only Binance in spot and derivatives transactions.

Bybit’s Fortunes Rebound

Bybit’s recent success mirrors the overall recovery of the cryptocurrency market. Bitcoin prices have doubled over the past year, bolstered by the introduction of dedicated US exchange-traded funds (ETFs). This recovery signifies a significant rebound from the 2022 bear market and scandals, including the collapse of FTX. The positive market sentiment has provided a fertile ground for Bybit to grow and innovate. To capitalize on this positive trend, Bybit has introduced features such as cross-margin trading accounts, which allow users to leverage unrealized profits for new positions. This appeals to traders seeking an advantage in the recovering market. Bybit’s platform offers a range of advanced trading tools and features, catering to both novice and experienced traders.

Europe is Bybit’s largest market, accounting for 30-35% of total volume, while the Commonwealth of Independent States (CIS), primarily Russia, contributes around 20%. However, Bybit faces challenges in Russia, where crypto usage is closely monitored due to potential sanctions violations related to the Ukraine war. The regulatory environment in these regions necessitates careful navigation to ensure compliance and continued growth. Bybit carefully screens Russian clients and adheres strictly to sanction rules. To enhance compliance, Bybit is opening an office in Georgia and seeking a digital asset license, building on a permit obtained in Kazakhstan last year. This move is part of Bybit’s broader strategy to establish a strong regulatory footing in key markets.

Bybit’s Dual Focus on Regulation and Market Growth

Bybit’s growth trajectory is occurring alongside increased regulatory scrutiny in the digital asset industry. The recent $4.3 billion settlement between Binance and US authorities over sanctions and anti-money laundering (AML) violations, which also saw Binance co-founder Changpeng Zhao face jail time, highlights the intensified regulatory control in the sector. These events emphasize the crucial need for stringent regulatory compliance and proactive risk management within the cryptocurrency industry.

Historically recognized as an exchange serving primarily overseas customers, Bybit is now adapting to evolving regulations. CEO Ben Zhou noted that the new Markets in Crypto-Assets Regulation (MiCAR) in Europe restricts certain products, prompting Bybit to seek new growth areas such as Brazil, Turkey, and Africa. This strategic shift aims to diversify Bybit’s market presence and reduce regulatory risks.

In addition to geographical expansion, Bybit is strengthening its relationships with prime brokers, essential players in crypto market liquidity. In May, Bybit initiated a “compliance review” of its interactions with prime brokers. “Now, if you are a prime broker, we need to know who you are dealing with,” Zhou explained. This move is designed to enhance transparency and build trust in Bybit’s operations, ensuring that all partners meet the highest standards of compliance and integrity.