Crypto Market Dead

The crypto market has registered huge losses over the past month. Price values of the two largest cryptocurrencies, Bitcoin and Ethereum, have fallen to greater extents by market capital. Over the past few weeks, Bitcoin has fallen around 20% and Ethereum about 28%. This period also saw the largest three-day fall in crypto market history since May 2024, culminating in a $314 billion drop of its total capitalization during early August.

This combination of reasons is what has driven the market to be labeled as “”boring”” in the eyes of many investors and enthusiasts. So here are a few reasons why this crypto market is in the current state.

Key Reasons for Market Downtrend:

Lack of Major Price Movements

The main argument for calling the crypto market boring today was lack of major price action. The number 1 cryptocurrency, the leading Bitcoin and other major altcoins are ranging in the market without any significant uptrend growth or downtrend decrease. For example, in recent days, as bitcoin oscillated between $62,500 – $57,200, many sat on the sidelines, fearful of an economic crash and concerned about PPI & CPI data coming down the pike.

Another example is Ethereum. In the last 30 days, it has lost more than a quarter of its value—driven by everything from $100 million in Ethereum (ETH) being dumped on the market by VCs to triggers much further away.

Regulatory and Economic Uncertainties

Regulatory changes and macroeconomic uncertainty Regulation-related news, announcements of economic authorities worldwide are another important reason that the market finds itself in its current state. Investors are on a knife edge as the U.S. Federal Reserve ponders their next steps in relation to interest rates.

This could affect market dynamics in the future as well, though — there is a 70% chance of cutting by another 25 basis points in September, according to the CME FedWatch Tool. But until those decisions have been made, the market is in a game of wait-and-see, which dampens trading appetite and therefore volatility.

Decreasing Investor Interest and Market Sentiment

But as well, what role investor sentiment has been playing in the relative quiet of the crypto market? This has been a narrative of investors getting more negative on the space amid events like BlackRock’s Bitcoin ETF facing major outflows. At the same time, whale selling has driven down sentiment with a drop in market making from dominant holders. For example, multiple Ethereum whales have transferred large quantities of ETH to exchanges in a potentially bearish indicator for the mid-term and stifled volume across all markets.

In addition, even though Bitcoin continues to take the lion’s share of attention in many respects and new tech such as modular blockchains or Layer-2 solutions attracts plenty of excitement market-wise, nothing has moved yet. This implies that the market has become fragmented and speculative orientation is getting unstable compared to its past situations (Coinbase).

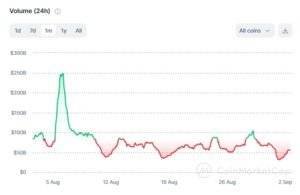

Decrease in Trading Volume and Volatility

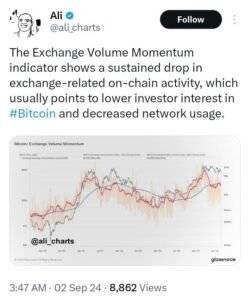

A significant reason for the crypto market being considered boring is that there has been an uptick in declining volume and thus a decreasing amount of intrigue potential. Bitcoin On-Chain Analysis Related: Bitcoin Public Key To Address, Biggest Lie Ever Various trustworthy sites have enlisted this information in their reports as well. According to CoinGecko website 2024 crypto industry report of (Q2), trading volume of Bitcoin (BTC) has fallen by 21.6%, and it is also noted that subtotal market cap has crashed more than -14.4%. The decline in trading volume typically mentions a reduced significant statistics of price action, which gear up market fervor and volatility.

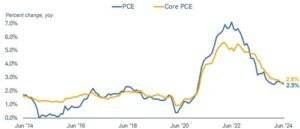

One reason would probably be that macroeconomic conditions have leveled out and this helps volatility on most levels. Inflation rates are showing signs of running on a more even keel, and the markets face fewer mystery moves from central banks like the Federal Reserve as it navigates away from interest rate hikes. An overwhelming focus on the last two months of what appeared to be a fever pace in projected rate hikes and their impact across risk assets, including crypto, has abated as there is less dry powder left with which broad movements can occur.

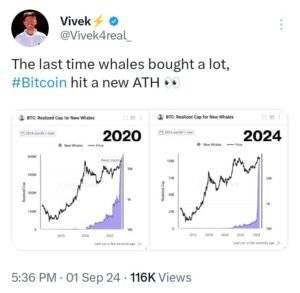

Whale Accumulation and Market Consolidation

Retail trading has cooled off, but “whales” have been stockpiling some tokens like Toncoin, Uniswap or Lido DAO. Buying and storing this massive quantity means that price is stabilized because large amounts are bought for the long term, diminishing the change between original market value.

This may be attributed to whales targeting undervalued tokens instead of engaging in speculative trading.

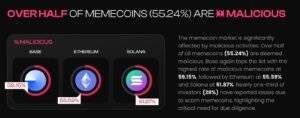

Meme Coins Reduction Impact and New Narratives

In previous times, meme coins were created and new trends took place like that of non-fungible tokens (NFTs), leading to the long-anticipated expectation in the crypto market. However, fresh data reveals the allure of those stories has dulled.

The Q2 of 2024 have also seen the meme coins only representing a market share of 14.3%, highlighting that, though they remain prevalent, recent narratives have been unable to govern headlines and attract the collective conjecture (CoinGecko).

A Move to Yield and Stability

As the enthusiasm of breakneck returns fades, investors are looking on to a more predictable future. The use of stablecoins, as well as decreasingly volatile tokenized money market funds (secured with traditional financial assets like U.S. Treasury bills), is ever-growing.

While on the one end these instruments bring stability to the ecosystems in trading but at other leads, less volume of trade and hence lesser price movement for cryptocurrencies (markets.businessinsider.com).

Change in Investment Approaches

A shift of investment in market strategies is adding to the current strong feel. Investors are starting to pile into safety and yield instead of waiting for speculative trading. As an example, we have just seen significant inflows into digital asset investment products as investors see the recent falls in prices as a great buying opportunity and still much more upside potential for outsized returns.

Investors have more than $75 million staked on their favorite chains being destroyed in a dark forest. After Black Thursday, Ethereum has become famous for its ability to receive millions of investment dollars from blue-chip organizations each month.

Impact of Market and Economic Indicators

More general economic factors and central bank influence on investor confidence are seen to be closely followed by the crypto market. Investors have been on edge since recent signals from the Federal Reserve, during 2024 meetings and in its official statement last week, about possible rate cuts.

The market has already leveled in a rate cut of 25 to 50 b/p, we believe this will have a vast impact on the financial markets when it comes. Still, with nearly two months before those issues were settled and more economic data on the way. There is a lot of hesitation among most of the investors to make courageous moves.

Supply-Demand Trends and Historical Performance

It is absolute that the crypto market will have periods of lower activity like in any other sort of market, and it happens at certain times each year historically. Over the years, August and September have been sluggish for much of Wall Street. In view of this market ambiance, muted already by economic and regulatory uncertainties, the seasonal trend will make a big change or breakthrough less probable.

Investors could also be waiting for the next Bitcoin halving, which is occurring in late 2024 (Cryptonews). Anticipation of that sort may stop investors from making big moves with mid-level events still on the horizon.

Lack of New Catalysts

Innovation & Hype rule the crypto market. There has been a dearth of major tech milestones or product introductions in the past several months, which have tended to get investors excited about things.

In traditional markets, there have been few major events, like new protocols or interesting blockchain projects, that held traders` attention as they used to.

Macroeconomic Conditions

Among a lot of significant factors, there was one very important reason that made the state in crypto what we see today and thus this is how things went. Investors were rattled by poor data, weakening growth in the major technology stocks and fears of a recession. What is also bearish for financial markets, including crypto, are the moves made by central banks— such as raising interest rates like the Japanese Bank of Japan. (Cointelegraph)

Conclusive Analytics

This current state of the market may look less exciting than it has in the past, but this lower volatility and caution could well be a period for consolidation. With the influx of news and regulations, it is possible to see a renewed pace in volumes and activity. For now, though, the likes of which have been accustomed to its comparatively higher stakes for obvious reasons may still argue that “the crypto market is boring.”

Market competition based on recent market data and observed trends September 2024 This is yet another case for why investors must be aware and reflective in their investment decisions when it comes to the rapidly changing environment of cryptos.