What is a Fed Rate Cuts?

Fed rate cut A rate cut by the U.S. Federal Reserve in the federal funds rate, which is the rate at which banks lend to each other overnight; It really is just a tool to try and influence wider economic activity. In times of a slowing economy, the Fed reduces rates to spur borrowing, spending and investment by making credit easier. It makes borrowing more affordable for businesses and encourages household spending, thereby stimulating the economy.

In 2008 financial crisis and 2020 pandemic, for instance, the Fed cut interest rates to just above zero percent to prop up the economy. According to this mentality, the looming September 2024 cut would calm markets and release pressure on the economy by providing cheaper lending.

What Does a Fed Rate Cut Mean for the Economy?

Interest Rate Decrease: Spread Throughout the Economy Lower interest rates lower the cost of borrowing, which can help consumers and businesses. If you reduce interest rates on mortgages, car loans, and business loans for example then this opens the economy to more spending and investments. It helps spur job creation and drive increased consumption of goods and services or economic growth.

In financial markets, the yield on traditional low-risk assets such as bonds also falls, so they become less of a draw. Investors frequently rotate into more risk-on investments such as stocks and cryptocurrencies to target higher returns. Meanwhile, a rate cut by the Fed can also dilute the US dollar which could cause some people to look for alternate safe-haven asset classes such as gold and now more often cryptocurrencies.

How a Fed Rate Cut Impacts Cryptocurrency Markets

Fed rate cut is usually good for cryptocurrencies If traditional financial assets, such as bonds, are offering low yields, the standard response of investors is to chase higher returns in riskier markets. This is when there is more interest for cryptocurrencies which are inherently volatile to begin with. This will make it cheaper to borrow and more liquid for both institutional and retail investors looking to allocate more capital into digital assets like Bitcoin and Ethereum.

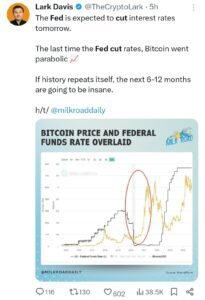

Take the cuts from the Fed in 2020, for instance: thanks to the large inflow of institutional money into the cryptocurrency market, Bitcoin saw prices boom after. This presumed 25 basis point rate cut on the morning of September 18, 2024 would likely incite a similar speculative interest in crypto as return prospects in traditional assets begin to wither.

Rate Core Risks and Opportunities for Cryptocurrency

Although the Fed rate cuts would create opportunity in terms of growth in the crypto market, it comes with a risk too. Cryptos are notoriously volatile assets, can and will go down significantly after rallying in response to economic stimulus. A rate cut from the Fed means a boost in the prices of crypto currencies. Investopedia told CCN that price spikes in Bitcoin on July 31st last year and on January 30th this year were caused by speculative trades rather than real buying. The amplified appreciation and depreciation in no time frame make it very dangerous for novice investors to fine tune the crypto market.

As one example, after the Fed cut rates in 2020, we saw Bitcoin balloon from $6k in March 2020 to an ATH of over $60K by April 2021. That said, the upsides were interspersed with bouts of truly manic volatility and massive 20-30% price drops that happened over just a few days. This volatility means a chance but also that novice traders could lose a lot as well.

Most importantly however, is that the regulatory environment itself influences how cryptocurrencies perform after the Fed cuts rates as well, along with their own normal volatility. Regulation: As digital assets are increasingly in the sights of governments and regulatory bodies, any increases or decreases to digital asset regulation can have a positive or negative effect on market sentiment. During the middle of 2021, cryptos went into a tailspin as China declared a war on crypto mining and transactions while at the same time most traditional assets were still supported by extremely low interest rates.

Investors also need to consider inflation risks. Despite the fixed-supply narrative that cryptocurrencies like Bitcoin are often pitched with (as a hedge against inflation), the entire crypto market is still speculative. Though a positive development most of the time, since it can also create price bubbles as capital quickly floods in which happened shortly after Fed rate cut. When inflation rises, the Fed could switch tactics and begin to hike rates a tightening of liquidity that would cause crypto prices to rapidly drop.