Bitcoin Boom

Surge in Bitcoin Price and ETF Inflows

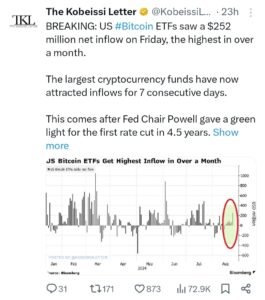

Current events in the digital currency scene resulted in notable current occasions and volatility when it comes to bitcoin price and Bitcoin ETFs. By late August 2024, the price of Bitcoin has hit an astonishing $64,000 on speculation that US Federal Reserve rate cuts were just a little way over the horizon paired with huge inflows into Bitcoin exchange-traded funds (ETFs). Recent reports are suggesting that Bitcoin ETFs have received inflows near all-time highs, reflected by $252 million flowing in just lightning-quick time. The influx of money illustrates a growing institutional interest in Bitcoin, on top of the normalization of digital assets within traditional financial markets.

Bitcoin ETFs Gain Traction With Positive Momentum

US Bitcoin ETFs saw their eighth day of positive performance, with great momentum for the last week. The longer the trend of consistency with this up-trend pattern, the more it shows an overall strength in investor sentiment towards Bitcoin as a genuine asset class. The results represent continued positive performance and are driven by a combination of macro backdrop and pending retail/institutional attention. Indeed, ETF inflows are yet more early evidence of wider acceptance among traditional investment outlets as a factor in the current price spike bouncing Bitcoin higher.

Challenges with Regulatory and Settlements

Meanwhile, the regulatory challenges facing Bitcoin prices and ETF flows make these bullish trends somewhat less impressive on their own. Last week, the SEC settled with crypto trading platform Abra for offering unregistered securities. The settlement is further evidence that regulators are cracking down on the industry and enforcement actions for noncompliance will come swiftly into play given recent changes to AML requirements, making transaction monitoring more important than ever. The short of it is the SEC recent crack down on all things crypto, part and parcel with a larger move by regulators to bring new cryptocurrencies more in line with traditional financial regulatory guidelines.

Crypto Scamming Enforcement Regulatory Actions

Enforcement action for scams has taken its toll on the cryptocurrency market as well. The SEC has been forced to get tough about the $60 million Onecoin Ponzi scandal, one of a number of completed cases where regulators are trotting out severe penalties for wrongdoers in rather sensational style. These enforcement actions are important to “maintain market integrity and protect retail investors from false schemes´´. A trend in the market is beginning to show that regulatory bodies are clamping down on fraudulent practices due to their prevalence, which may potentially influence how crypto businesses conduct themselves and comply with relevant regulations.