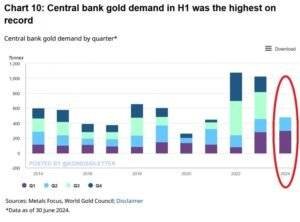

Central Banks Gold Rush Raise Reserves Amid Economic Uncertainties

Now, with the onset of 2024, central banks everywhere are buying more gold than they know what to do with. It is mostly due to the economic uncertainty, the battle of power in global events, and also inflation on the rise. In the turmoil that follows a global financial meltdown, central banks will definitely look to spread their reserves across more safe-haven assets, such as gold.

This development will only be accelerated by the ongoing de-dollarization efforts, especially of countries like China and Russia. Nevertheless, in spite of the colossal investment into Gold, Bitcoins has performed better than it .This dichotomy highlights the ongoing tug-of-war between traditional and digital assets as long-term value stores, even though Bitcoin has clearly made its mark on a global economic scale.

SBI and Ripple in Japan A strategic Partnership

The news comes after Ripple secured a powerful foothold in Japan through its relationship with SBI Holdings, one of the country’s largest financial conglomerates. The alliance, the statement continued, is more than a business partnership; it represents a strategic push to grow blockchain and digital asset adoption throughout Japan. This initiative should drive innovation in the financial services sector, given Japan’s progressive stance on crypto regulation, positioning itself as a country where ”cryptocurrency businesses are prospering.

With the participation of SBI, Ripple is in a strong position to help shape wider regional regulatory frameworks and financial services practices with their technology. The move also underlines Ripple’s continued ambition to grow its worldwide presence, especially in jurisdictions that are already awake for the adoption of blockchain technology.

OKX Singapore Secures Full Payment License, Marks a New Era in Fintech

Fintech sector players witnessed a landmark day as the Monetary Authority of Singapore (MAS) on Friday announced to have awarded prominent digital assets exchange OKX a full payment license in the city-state. This marks a further step towards OKX offering deeper, and more regulated financial services on one of the world’s strictest compliant environments. The license acquisition demonstrates OKX’s commitment to operate in a regulated manner as they further expand their global market positions.

The company has also named a former MAS official as its CEO, indicating that it is looking to work in tandem with regulations for further expansion. While enhanced license may mean that Okex is finally in a position to say its roots deep into Singapore, trading platforms with similar aspirations operating in every similarly regulated market can use the guidelines as steering.

Bearish Death Cross Signal Heads to Binance Coin (BNB)

The Binance coin (BNB), a well-known cryptocurrency market player, recently fell victim to the so-called “death cross,” under which is meant that its 50-day moving average crossed below the 200-day MA. I notice this pattern as a bearish signal, meaning the asset’s price could fall even more. Add in the negative funding rates, which are contributing to bearishness, and you have a recipe for more downside.

Many of the investors, unfortunately, due to the death cross, have heightened the selling pressure, so many of them are, in a bit sadistic way, taking precaution. Despite the ongoing growth of its native ecosystem in terms of new development, products, and expansion that are noteworthy catalysts informative for BNB prices, bear market technical formations point to mounting troubles ahead. Market participants are watching this development closely to assess these potential threats compared with the long-term features of Binance Coin.