Crypto Market Summary

BlackRock Bitcoin ETF Shatters All Records in Inflows

BlackRock’s Bitcoin ETF, IBIT, has garnered so much attention in the cryptocurrency investment world as it received $64.8 million of net inflows within six days from its launch. The trust among investors can, in part, be explained by BlackRock’s reputation as a reputable asset manager and the competitive framework of the ETF, two significant drivers for this landmark success.

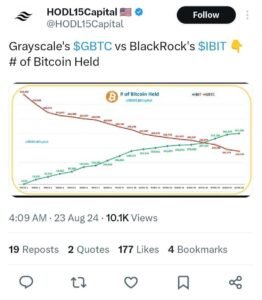

Unlike Grayscale’s GBTC, which is seeing outflows recently over market conditions, IBIT arose to take advantage of the low fees and standards in place for its regulation. The performance of the fund is a direct reflection on just how seriously traditional institutions are now taking Bitcoin, especially in more officially packaged investment products.

It is important not just for its success as a product but also for what it shows: going from retail to institutional acceptance of Bitcoin and digital assets. If anything, the interest from BlackRock will help lend credibility and comfort to investors, especially following regulatory clamp downs and market turmoil.

While I’m glad the benefits are there, such as guaranteed security and regulatory compliance, which is an attractive feature for first time mom-and-pop investors without getting them sacrified by direct exposure to a digital asset product,. Such a product could spur adoption of Bitcoin ETFs more broadly, and thus impact the behavior of both retail and institutional investors.

Russia Moves to Regulate Cryptocurrency with State-Controlled Exchanges

Russia will launch two or more state-controlled cryptocurrency exchanges, an increasingly pronounced maneuver to enforce different measures around digital assets. Banning cryptocurrencies like Bitcoin is part of a larger strategy to put control over the industry back into government hands. These exchanges will be regulated, with a focus on transparency and complying with money laundering laws. The platforms target a range of illegal activities, including money laundering and tax evasion, which Moscow has repeatedly promised to crack down on.

Russia recently established these platforms, which are partly a response to the advance of blockchain and digital coins. In fact, the Russian authorities have at least cautiously embraced the potential of blockchain and its probable benefits, such as increased transparency and efficiency in terms of finance. The government’s need to control the new forum and exchange spaces will allow it to better manage the potential risks associated with them and enable creativity while still imposing certain restrictions and constraints.

The move is considered preparatory to the process of making the ruble digital, making it easier for them to assert that in the foreseeable future, more digital assets will be trusted in the process of implementing finances in the country. In general, the regulatory solution in Russia could have a significant influence on the market for digital currencies across the globe.

Sony Enters Blockchain Space with Soneium Ethereum Layer 2 Solution

Sony releases Soneium, an Ethereum Layer 2 Solution Sony has taken a major leap into blockchain technology by launching its Layer 2 scale-down solution on Ethereum called Soneium. The Soneium testnet focuses on solving a few of the biggest issues facing the Ethereum ecosystem, such as the cost and speed of transactions. Layer 2 allows Soneium to enhance their capacity on Ethereum and facilitates quicker transaction speeds while also reducing expenses, both of which are essential for the growth of dApps that operate on a decentralized network.

Australian Court Ruling Takes Bite Out of Kraken

A major legal setback in Australia has put Kraken one of the world’s largest cryptocurrency exchanges by trading volume on its back foot, as it was forced to surrender a court fight against Australian Securities and Investments Commission (ASIC). At issue was whether Kraken’s margin trading offerings were a credit facility within the scope of Australian regulations, and thus required specific licensing.

Kraken is not able to offer these services again unless and until it has the relevant Australian financial licence required from ASIC, which could potentially have a wider impact on its geographic activities within the region.

The case underscores the heightened regulatory attention cryptocurrency exchanges are grappling with worldwide. This legal disappointment could well prompt Kraken to evaluate its compliance tactics not only in Australia, but also all around the world, across jurisdictions with demanding financial rules. The ruling may prove to be a cautionary tale for dozens of other exchanges that operate in the same murky

legal space, and underscores the importance of complying with local laws and securing critical licenses. So, in an environment where regulators across the globe are significantly extending their control into crypto space, exchanges like Kraken have to operate on a moving battlefield of regulatory changes just to defend people using its services and maintain or gain market share.