Ethereum at a Crossroads

The world second-largest cryptocurrency, Ethereum (ETH), is undergoing its most significant decline since three years back Following the Ethereum Highway shut during September 2022, the asset fell up to 53%, resulting in an even greater drop from a ratio of 0.038 ETH/BTC that had not been seen since April 2021. The performance brought wider crypto market influences into play, with Ethereum buckling under selling pressure relative to Bitcoin (BTC), the latter of which moves within a tight range over the past 24 hours. Ethereum has been priced at approx $2,295 while the market sentiment is bearish as there are multiple factors affecting it.

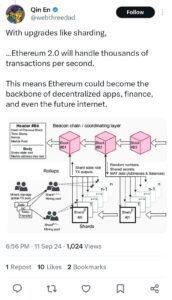

There are numerous reasons why Ethereum has underperformed. The Ethereum 2.0 upgrade, which has been long anticipated for its improvements in scalability, energy efficiency, and lower transaction costs has slowly rolled out first. The Solution In the short run, Dfinity can reorganize its priorities in order to compete with fast-growing blockchains such as Solana and Avalanche, where investors and developers are turning due to diminishing confidence. The decree has also resulted in a drop of Ethereum´s dominance in the market, which amounts to some 18% as oposed to Bitcoins 48% and makes it less likely that ETH will recover short term.

Ethereum’s Pain Points: DeFi and NFT Sectors Dominates

In the last 5 years, Ethereum share in DeFi and NFT markets is also decreasing. And in 2021, Ethereum’s DeFi platforms maintained a TVL of $88 billion. Now in 2023, The DeFi market is hovering around $30 billion, Defi Llama. A substantial portion of liquidity has been drained from Ethereum due to the emergence of other blockchains with reduced fees and faster transaction speeds. These platforms are taking positions in the DeFi markets and competing for Ethereum´s market share as is the case of Solana.

The NFT market, the only remaining allure for Ethereum which had merit, has seen transaction volumes shrink heavily. This has led to a slowdown in NFT sales (which are largely built on the Ethereum blockchain), further reducing turnover on the network. Additionally, the scope of this decline can be attributed to skyrocketing gas fees on Ethereum in 2023, regularly around $4 per transaction, significantly squandering its relative appeal to recent blockchain and protocol technologies like Polygon emerging from Matic Network boasting much lower transaction prices.

News of these sectors instructed to more mixed the stress, has sent Ethereum purchasing energy downwards sharply with market experts proposing 0.030 as the forthcoming fall of the ETH/BTC proportion before any indicators reverse.

Can Ethereum Turn It Around?

Despite lagging behind in recent years, Ethereum’s future isn’t all gloom and doom. Promised a major drop in the amount of energy used by Ethereum, up to 99%, as well as reduce transaction fees, this is of course Ethereum 2.0. This could return Ethereum to the front of pack, as a candidate more sustainable and scalable long term Blockchain platform IF successful. Ethereum 2.0 could potentially appeal to institutional investors looking for something greener as well as faster and cheaper in comparisons than the first generation of Ethereum.

Even as it has recently underperformed, Ethereum is and will continue to be a lynchpin in the blockchain ecosystem. With over 3,000 decentralized applications (dApps) still functioning on its network and unquestionable display of innovation from developers in its strong ecosystem. Ethereum is in the unique position where it has yet to be obsoleted by faster and more scalable platforms, but that could change quickly.

The recovery of Ethereum is thought to be a tune, so it may take a long time and the growth is anticipated even beyond 2025 according to some analysts. Ethereum 2.0 is coming, but for now it remain confined to create a solution to too many fees and delays in upgrading before regaining dominance as the king of Altcoins.