U.S. Recession Risks on the Rise: 6 Global Economic Concerns

Reserve JP Morgan’s CEO, Jamie Dimon, has warned that a U.S. recession is inevitable and jumped to a 35%–40% estimated chance. That caution follows a week of stock market turmoil, which has erased more than $2 trillion in wealth. Behind the U.S. marches European instability, which, taken together with rising deficits and an unkept housing market in America, creates an imperative that is anything but restful for global markets, especially emerging economies within BRICS (Brazil, Russia, India and China) (collectors).

When a U.S. economy totters, the global implications highlight how intertwined we all are in this mess of an economic landscape we call home today.

Strategic BRICS Move Towards De-Dollarization

The BRICS (Brazil, Russia, India, China, and South Africa) are launching a very strategic move that could surprise the world as early as this week; mostly underpinned by gold. This de-dollarization approach includes the promotion of trading in local currencies, as well as a potential new currency tied to gold. In this arena, Russia and China are leading the charge as they work to insulate their economies from U.S. economic coercive pressure within a more equal continental-scale global economic system.

Yeah, sure, this process will take time, but with accumulating gold and other strategic moves, they are making a major shift that could eventually be an existential threat against the US Dollar as well.

What BRICS are Expanding and What This Means for the Economy

The latest addition of six new members (Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE) to BRICS is a landmark event in global economics. In combination, BRICS now comprises close to 47 per cent of the entire world´s population and a considerable share of global GDP – thus offering itself as a powerful opponent against Western economic hegemony. These new members are expected to boost intra-bloc trade and negotiation strength at the global level. It is a long-term plan by BRICS to leverage its economic power and gradually move away from western economies, redefining the current global balance of financial power.

How Bitcoin Fits Into the Swelling Global Economic Jigsaw-puzzle

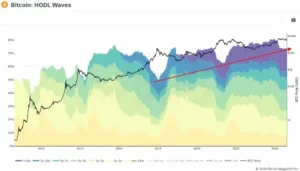

With traditional markets under desperate strain, Bitcoin is an incredibly fortuitous asset on this occasion, with 75% of its maximum supply remaining untouched for over six months. The steadfast willingness to HODL bitcoin is a sign of the greater bullish disposition among investors, and more faith from those who now own this digital asset in its future. Another driver for the store-of-value narrative around Bitcoin has come with increasing concerns over fiat, spurred by BRICS nations aiming to de-dollarize. Over the past several months, we are fast approaching a broader trend among emerging markets to seek digital alternatives that speak volumes about an expanding shift towards decentralized methods of storing and sending value in times rife with economic distress.

These developments certainly signal the quick transition of an international economic landscape that is critical for worldwide commerce, fiscal stability and determining which currencies will be whooping used from this point forward. The BRICs strategic moves in addition to the resilience Bitcoin indicates world economic changes from a unipolar period, echoing more multipolarity that is most likely being extended by emerging forces contesting classic center powers.