Grayscale Survey Insights

The recent approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) has sparked significant interest among American voters in cryptocurrency investments. This landmark decision, detailed in a Grayscale survey released on Tuesday, indicates a shifting landscape in voter investment preferences, driven by various economic and geopolitical factors.

Growing interest in Bitcoin due to economic uncertainties

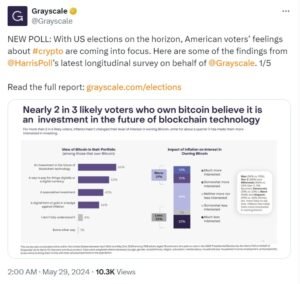

The Grayscale-commissioned Harris Poll, conducted online between April 30 and May 2, 2024, among 1,768 adults, reveals that several key factors are driving increased interest in Bitcoin. These include global events, the growing legitimacy of Bitcoin, and inflation fears. With inflation cited as the top concern by 28% of voters, Bitcoin’s fixed supply is becoming increasingly attractive as a hedge against economic instability.

Geopolitical tensions, a weakening dollar, and the recent approval of spot Bitcoin ETFs have further amplified interest. The survey shows that in the past six months, there has been a notable uptick in voter attention towards Bitcoin, with nearly one-third expressing a heightened interest in learning about or investing in cryptocurrency this year.

Investment tendencies and political influences

The survey indicates a significant shift in how voters view cryptocurrency as a long-term investment. Compared to November 2023, more voters now consider crypto a viable long-term investment (23% vs. 19%), and an increasing number plan to include crypto in their investment portfolios (47% vs. 40%).

Politically, the topic of cryptocurrency is gaining traction. Presidential candidate Donald Trump has made cryptocurrencies a central part of his campaign strategy, emphasizing his support for the industry and criticizing President Joe Biden’s approach to crypto regulation. Trump’s recent statements on Truth Social highlight his commitment to protecting the vitality of the crypto market, which he claims Biden aims to stifle.

Cross-party support and potential future consequences

Grayscale’s survey also reveals that interest in cryptocurrency is not confined to a single political party. An equal percentage of voters (30%) believe that both Democrats and Republicans are supportive of crypto, indicating bipartisan appeal. Ownership levels are similar across party lines, although the priorities differ, with Republicans focusing more on economic issues and Democrats on social concerns.

As crypto gains popularity, particularly among younger voters (with 62% of Gen Z and Millennials believing in the transformative potential of crypto and blockchain), the approach of the next administration toward cryptocurrency regulation will be crucial. This demographic’s belief in the future of crypto underscores the need for thoughtful regulation to support the growing interest and investment in digital assets.

The approval of spot Bitcoin ETFs by the SEC is a pivotal event that has significantly increased voter interest in cryptocurrency investments. Driven by inflation fears, global events, and the legitimization of Bitcoin, this trend is reshaping investment preferences and gaining traction across the political spectrum. As the 2024 presidential campaign unfolds, candidates’ stances on crypto issues will likely influence voter behavior and the future of cryptocurrency regulation in the United States.

There Are More Latest News Here.