Over the years, cryptocurrency markets have acquired a position in an ever-changing and rapid environment that has been attracting both seasoned investors and novices. Not all the thousands of digital currencies were created equal. Many of these shitcoins are used in reference to deteriorating-value coins with no hope at all. This has always been a risky world for new traders, especially with the rise of shitcoins (low-value coins) that prey on those who do not know well enough or are brought in by hyped-up promotions.

Shitcoins have had an unmistakably impactful role in the cryptocurrency space. As of 2024, there are more than 200,000 different cryptocurrencies in the world!! Of which a good proportion are shitcoins. Indeed, they frequently appear following the rise of a bar-setting digital currency, at which point people hoping to get in on the same kind of action make their own, derivative coins. So in this article, we are going to learn what shitcoin is, how it works, and other questions like how you can identify those coins and if they could be a potential place for investors.

What is Shitcoin?

In the cryptocurrency industry, a shitcoin is described as any digital currency that has an insignificant amount of intrinsic value or underlying technology. Shitcoin is a pejorative term used to describe coins that have nothing new or show no purpose.

Shitcoins are usually created through initial coin offerings (ICOs) or forks of existing cryptocurrencies without any significant changes. These are the coins that have no meaningful real-world application, juvenile development teams, and essentially thrive on speculative disproportion as opposed to long-term value addition. In 2017, for instance, more than 80% of ICOs were adjudicated as scams or failures (even seekers have complained that everything but ether is “a shitcoin”). It simply extends the same pervasive cynicism that most of those 10,000+ cryptocurrencies you see are speculative or outright scams.

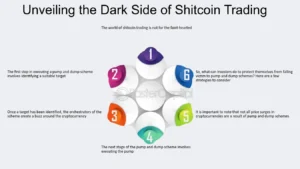

Mechanism: How Shitcoins Work?

All shitcoins go through a lifecycle, usually beginning with an ICO or similar fundraising event. This is how they typically function:

Creation and Launch: Developers create a new cryptocurrency, typically by copying the code of something like Bitcoin. They may have reworked the original code a little or not at all. The new coin follows an ICO of some sort, where investors can get in early and speculate on higher prices down the line.

Aggressive Marketing: Shitcoins are promoted by aggressive marketing. The coins are often marketed with claims of high returns, associations or upcoming projects that constantly fail to deliver. Generating buzz like this is often accompanied with social media and influencer endorsements.

Speculation and Hype (Pure FOMO): Investors buy the coin (hoping to get in before it takes off on another run). This becomes a self-fulfilling prophecy whereby the price is driven higher due to chasing after demand at its resistance level. The only catch is that that hype rests on nothing but speculation of value, as there is zero utility or technology behind it.

FOMO Leads To FUD: After the initial bubble finally pops (or even before then), and people start to lose interest as prices sink lower, creators either “dumps” on their bags or sell a large portion of their coin in one go into the open market, causing prices to plummet like so many that have gone belly up already. As a result, the value of the coin plummets, and many investors are left with coins that have no real utility.

Shitcoins tend to take advantage of an unregulated environment in the crypto space because investors do not have credible information that could contrast their enthusiasm with what the project actually involves.

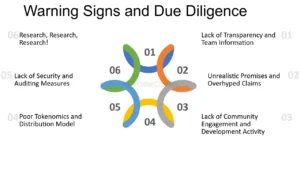

How to Identify Shitcoins?

It is somewhat of a challenge to be able to find these shitcoins, especially if you are someone who isn’t familiar with the field just yet. But there are some given red lights that will make sure that you do not fall while buying a shit coin:

No Practical Application: If the currency has no planned practical use or focuses on a theoretical problem, it may be a shitcoin.

Anonymous Team: Operational projects usually have a public team with verifiable experience. It’s a huge red flag when the team behind it is anonymous or has no previous history.

Aggressive Promotion: Shitcoins are mean there in aggressive marketing, which crams down your throat over-the-top promotions.I would promise you a ride to the moon, but when reality sets in.

Ordinary Market Cap: Though, this is not an accurate indication but it often signals that the coin is not significantly or deeply trustable.

Less Development Activity: Authentic cryptocurrencies have active development communities. If there is little to no activity on platforms like GitHub, it’s a red flag.

Slim Liquidity: If a coin is illiquid or scattered across the peripheries of the cryptocurrency exchange landscape, it might mean that there’s no real market for the coin.

Low Ownership Concentration: When a large fraction of the coin is held by 1 or n wallets, it can easily manipulate the market as they decide the direction and quantity to sell, even if it is for sale at all.

Copycat Coin: When a coin is an exact copy of another cryptocurrency and it has zero innovation, then they are most likely shitcoins.

Unrealistic Roadmap: Though not too lengthy, anything without specifics or evidence (no matter how revolutionary!) should raise red flags for you as an investor; this gives potential for an unrealistic roadmap.

Absence of Community Support: Without an active community, any cryptocurrency cannot be successful. The absence of an active user base indicates that a coin is either weak in networking and community-building, or it could be truly struggling to get adopters.

Top 5 Examples of Shitcoins

BitConnect (BCC): Potentially the crappiest of shitcoins, BitConnect was an obvious Ponzi scheme parading as a cryptocurrency. Seeking high returns, it fell into bankruptcy in 2018, and investors were exposed to huge losses.

Onecoin: One of the largest global pyramid schemes masquerading as a new emerging alternative to Bitcoin. It never had an effective blockchain and ranks among the biggest scams in crypto market history.

Useless Ethereum Token (UET): This coin was created as a satirical commentary on the senselessness of ICOs, basically. It was an obvious scam and useless, but people still invested in it. Difficulty at Work. getMiners, by The Jakarta Post It was only a matter of time before the stock markets started slumping with claims that bitcoin, just like cyberspace itself, had been overvalued all along.

B2X (SegWit2x): B2X was a hard-fork proposal to increase block size on Bitcoin by doubling the current 1 MB limit. The community did not back it up, and the term ‘shitcoin’ was coined accordingly.

DogeCoinDark (DOGED): A Dogecoin derivative that ultimately just tried to piggyback on the success of Dogecoins but was functionally similar and had no discernible innovation or purpose, so it faded into obscurity.

Characteristics of Shitcoins

In order to identify shitcoins, one should be aware of the main characteristics of shitcoins.

No Practical Value and Direction: Most Shitcoins are not solving any real-world problems or doing anything unique.

Lack of Technological Progress: These coins have little tech innovation and are often yet another clone coin.

Tiny Market Cap: They have a low market capital, which means little to no investment in confidence and/or adoption.

Insufficient Liquidity: Shitcoins are often difficult or impossible to buy (or sell), resulting in very large spreads that few if any investors realize but expose nonetheless.

FUD OR FRAUD: The Shitcoin Project shows insufficient transparency, in the form of undisclosed or unknown team member identities, unprofessional or no presence at all; many shitcoins also do not reveal their financial statements publicly.

Advantages of Shitcoins (Pros)

And as much as people hate on shitcoins, they do have some redeeming factors, such as:

The largest potential rewards: If you are willing to gamble your money and if the timing is right, shitcoins can pay out enormous returns in a very short amount of time.

Learning Opportunity: Shitcoin Investment as a Way for New Investors to Learn the Crypto Market Through Small Financial Commitments.

High Entry Barrier: Shitcoins have very low prices, so they are accessible to people with little money.

Flipping Potential: As shitcoins frequently benefit from price volatility, some individuals look at them as ideal investments that grant portfolios the flexibility to realize quick profits.

Clown-car Coins: A few shitcoins manage to construct insular clown-car communities that, though minuscule, are heavily engaged and sympathetic.

Disadvantages of Shitcoins (Cons)

However, the risks often outweigh the potential rewards:

Very High Risk: Most shitcoins are very volatile and investors risk losing all the capital invested.

Low Liquidity: If the market dries up and a shitcoin loses its popularity, selling it can be very hard.

Scams and Fraud: Half of the shitcoins are scams simply to extract money from novice investors.

Market Manipulation: Shitcoins are easy to manipulate in price, with a simple push down the prices going way too low and at others rising high.

Regulatory Risk: Governments are increasingly regulating the cryptocurrency space, and with shitcoins being so speculative, they might be first on their hit list.

Potential Risks of Shitcoins

There are many risks to investing in shitcoins. Below is a list outlining possible issues people may face if they get involved with the often less reputable coins. Rogue cryptocurrency (not necessarily from an official shitcoin, but this week it may be just that)… Crackdowns on unregulated cryptocurrencies are likely to remain the result of regulatory action. In 2023, global regulators issued more than 50 warnings related to unregulated digital assets—aa sign that there is an increasing focus on these products. Another crucial risk is volatility, since shitcoins are famous for their prices soaring through the roof. In the latter half of 2019, one or two shitcoins would tank by as much as 80%–90%, laying bare very heavy losses for investors.

Aside from the machinations of its markets, scams and fraudulent plague shitcoin existence with specious activity as yet one more outgrowth of crypto market anonymity and record-regulation failure. One report from 2022 estimated that as much as $3 billion was siphoned off in crypto-related scams, many of which revolved around shitcoins. On top of that, most shitcoins do not even manage to get adopted by anyone for anything other than speculation and betting, so they crash anyway due to a lack of use cases or market penetration. Finally, reputational harm is something to be seriously considered. Shitcoins by association can mar the reputation of both retail and institutional investors, which may result in a loss of confidence as well as opportunities for future financial markets.

Does It Make Sense Investing in Shitcoins?

The choice to spend in shitcoins is entirely private and subjective, as it depends on the individual’s threat resistance degree along with financial objectives. Shitcoins: despite offering potentially high rewards if successful, they also come with considerable risks. The possibility of massive losses is simply too great for the vast majority of investors to deal with in exchange for some quick wins. You need to do your own research and be aware of the risks before you put any money in a volatile market.

This is why perhaps a balanced portfolio strategy featuring more established cryptocurrencies over newcomers provides the kind of exposure and risk profile that might help one make it through to survive in this crazy crypto market.