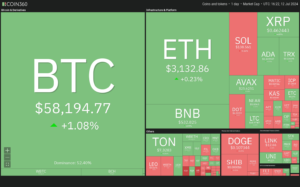

The crypto market is showing signs of recovery, with both retail and institutional traders taking advantage of Bitcoin’s dips. This trend suggests that the market might be in a bottoming phase. Bitcoin, in particular, has seen significant buying interest, rebounding from the $56,500 support level on July 12. According to CryptoQuant, institutional investors have purchased 100,000 Bitcoin in just one week.

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) is currently priced at $58,624. The recent bounce from the $56,500 support indicates strong demand at lower levels. Despite efforts to push above the 20-day simple moving average (SMA) of $59,650, bears have managed to keep the price down, reflecting negative sentiment. The key zone for bulls to defend is between $56,552 and $53,485. A sharp rebound from this zone could drive BTC/USDT to the 50-day SMA at $64,532. However, a break below $53,485 might signal a downtrend, pushing the price towards $50,000.

Ethereum (ETH) Price Analysis

Ethereum (ETH) is trading at $3,162. The long wick on the July 11 candlestick indicates selling pressure at the 20-day SMA of $3,239. The critical level to watch is $2,850. A rebound from this level could lead to another attempt to clear the 20-day SMA, aiming for the 50-day SMA at $3,499. On the downside, if bears pull the price below $2,850, ETH/USDT could drop to $2,200.

Binance Coin (BNB) Price Analysis

BNB is currently priced at $538. The price turned down from the 20-day SMA of $547 on July 11, indicating bearish defense. The next support level is $495. A rebound here suggests bulls are trying to establish a higher low, potentially breaking above the 20-day SMA. Failure to hold $495 could see BNB/USDT dropping to $460.

Solana (SOL) Price Analysis

Solana (SOL) is struggling to break past the 50-day SMA of $150, currently priced at $140. The SOL/USDT pair might remain range-bound between $116 and the 50-day SMA. A break below $116 could trigger a bearish pattern, driving the price to $100 and then $80. Alternatively, breaking above the 50-day SMA could start a relief rally towards the downtrend line.

XRP Price Analysis

XRP is trading at $0.52. The pullback to the 50-day SMA at $0.49 on July 12 shows selling pressure. The key level to watch is $0.46. A rebound here could shift sentiment from selling on rallies to buying on dips, targeting $0.53. Conversely, a break below $0.46 might see the pair decline towards $0.41.

Dogecoin (DOGE) Price Analysis

Dogecoin (DOGE) is consolidating in a downtrend, trading between $0.12 and $0.10, currently at $0.11. The bearish advantage is evident with downsloping moving averages and a negative RSI. A break below $0.10 could push the price to $0.08. On the upside, breaking $0.12 could initiate a recovery towards the 50-day SMA at $0.14.

Toncoin (TON) Price Analysis

Toncoin (TON) is trading near the 20-day SMA of $7.48, indicating ongoing buying pressure. A push above this level could see TON/USDT rising to $7.72 and potentially $8.29. However, a turn down from the 20-day SMA might signal strong bearish defense, with a break below $6.77 potentially leading to a drop to $6 and then $5.50.

Cardano (ADA) Price Analysis

Cardano (ADA) has reached the resistance line of its descending channel, trading at $0.42. The flattening 20-day SMA at $0.39 and a neutral RSI indicate reduced selling pressure. A break above the 50-day SMA at $0.41 could signal a short-term trend change, with the ADA/USDT pair potentially rallying to $0.50. A sharp turn down from the resistance line could pull the price towards the channel’s support line.

Avalanche (AVAX) Price Analysis

Avalanche (AVAX) is currently trading at $26.22 within a tight range between $27.50 and $24.50. A move above the 20-day SMA could push AVAX/USDT to the 50-day SMA at $30.39. Surpassing this level could see the pair rising to $34 and then $37.20. On the downside, a break below $24 might signal bearish control, potentially retesting the July 5 low of $21.80 and dropping to $19.

Shiba Inu (SHIB) Price Analysis

Shiba Inu (SHIB) is trading at $0.000017, struggling to rise above the 20-day SMA. The bearish trend is evident with downsloping moving averages and a negative RSI. A break below $0.000015 could lead to a drop to $0.000012 and then $0.000010. Bulls will aim to drive the price above the 20-day SMA, targeting $0.000020, though this level is expected to see strong resistance.

The crypto market is showing signs of recovery with significant buying interest, especially in Bitcoin. However, key support and resistance levels will be crucial in determining the next direction for these top cryptocurrencies. Institutional buying remains a strong factor, but the market’s overall sentiment will be tested by upcoming events and price movements.