Ripple files Form C to push back

In the ongoing Ripple Labs vs. The Securities and Exchange Commission (SEC) case, Ripple files Form C to push back with the U.S. Court of Appeals for the Second Circuit.

News of the filing, included as part X post by Ripple’s Chief Legal Officer Stuart Alderoty on October 25, comes in the middle of a fight from Ripple to overturn an adjudication that designated its sales institutional e-derivatives, almost after cryptocurrencies.

The case, in which Ripple received a $125 million fine and faces another huge penalty if it loses the argument that XRP is not contrary to U.S. securities laws, remind us of how much hangs on what classification falls under law within American territory for XRP specifically.

De Novo Review: A Fresh Start For Ripple?

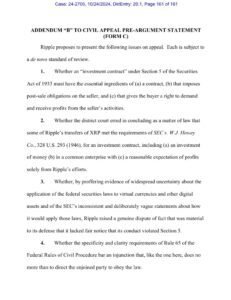

Ripple’s Form C filing is more than just a standard appeal — it’s actually asking for what’s called a “De Novo review”, an important procedural course of action that lets the appellate court reconsider any legal issues without considering previous conclusions made by the lower court.

This kind of review can allow Ripple to build its argument from the bottom up, reiterating their points in XRP not being a security on institutional sales. Ripple chief legal officer Stuart Alderoty tweeted his anticipation of the review last week, describing it as a “big one for Ripple [and] crypto.”

In a post by Alderoty, he also said that the SEC will not be able to put forth new evidence or ask Ripple for more documents during the appeal. He said the SEC’s approach was “misdirection and confusion,” but Ripple will continue to work toward interpreting what this means for cryptocurrencies as a whole.

Why the Form C Filing Matters

Ripple is taking advantage of a legal provision called Form C, which permits Ripple Express to dispute both procedural and interpretive aspects of the District Court’s ruling.

Alderoty emphasized the importance of this action in his announcement, explaining that it would mean “the SEC cannot submit new evidence or request [Ripple] to produce more,” therefore reducing the likelihood of further complicating proceedings on behalf of the regulator. That narrowed scope could be helpful for Ripple, which is fighting the classification of its institutional XRP sales as a type of securities transaction, which would set sweeping precedents for other tokens.

Ripple’s appeal of the found against them on institutional sales does not contest that XRP is a security for programmatic sales (sales via digital asset exchanges), which were previously ruled to not be securities by the District Court.

Ripple instead focuses their appeal on the sales directly to accredited investors, claiming they do not satisfy Howey test prongs.

Ripple’s position highlights a larger issue with the vagueness (or lack thereof) of current securities law as they relate to digital assets — something that Ripple and others in the crypto space have pointed out repeatedly as regulators ramp up their enforcement efforts.

SEC’s Position: The Complex Tug-of-War

The appeal comes as part of the SEC’s own ongoing appeals that dispute certain components of the District Court gaining summary judgment in favor of Ripple.

When the SEC did not appeal the part of the ruling that XRP isn’t a security when sold on digital asset exchanges, it did ask for next guidance and review in terms of institutional sales.

U.S. District Court for the Southern District of New York Judge Analisa Torres gave Ripple some respite from the drawn-out legal battles in July 2023, ruling that XRP does not qualify as a security in programmatic sales.

But the mixed ruling—splitting XRP status transaction by transaction—leaves both parties scrambling in what could turn out to be an important test case for the regulatory response to crypto.

Crypto Regulation — The Ripple Effect

Ripple’s ruling reflects wider issues in crypto with clarity, or a lack of it, among regulators. A victory for Ripple on this de novo review may provide precedent narrowing the SEC’s application of the Howey test to crypto sales across the board.

Thus, Ripple’s case may influence the way courts look at direct digital asset sales going forward and all its implicating securities determinations under time-honored securities laws.

With the digital asset industry expanding quickly, it is particularly important as we require regulations that uniquely cater to this new class of financial products.

In addition, the Form C filing is not merely a single hurdle; it symbolizes Ripple’s commitment to its continued position rather than allowing “distraction and confusion for Ripple and the industry” as induced by the SEC standing in the way of its determination to campaign for a suitable regulatory climate.

Ripple remains properly transparent against what it believes is regulatory overreach, which ‘Alderoty’ echoed in his post on X—and the company isn’t alone as many crypto companies continue to deal with maturing regulators.

What’s Next for Ripple and the SEC?

As both Ripple and the SEC handle their own appeals regarding parts of the original ruling, this case is set to continue through 2025 at least.

A de novo review would permit further consideration of several important points implicated by the District Court’s reading, whereas the SEC’s appeal could restrict or reshape the definition of a securities offering in relation to sales to institutions for crypto. A favorable outcome for Ripple, especially in relation to the potential misapplication of the Howey test, has the potential to provide a more stable regulatory backdrop for the industry.

Both parties are now at a crossroads in the process of appeals, where they risk millions as well as setting potentially precedent-establishing outcomes either way for the future of digital asset regulation. The eventual result will have implications for Ripple and a quickly changing sector operating in cloudy regulatory waters.