The cryptocurrency market has experienced significant fluctuations recently, influenced by various global events and market dynamics.

Market Overview

The global cryptocurrency market cap fell by 8.6% in the past 24 hours, currently standing at $2.08 trillion. Total trading volume increased to $147 billion, up from $107 billion the previous day.

Major cryptocurrencies such as Bitcoin and Ethereum saw notable declines, with Bitcoin dropping 5.4% to $54,447 and Ethereum falling 8.8% to $2,882.

Key Analytics

Mt. Gox Repayments and Bitcoin Price Impact

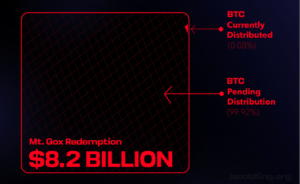

One of the most notable events is the repayment of creditors by the defunct Mt. Gox exchange. The movement of substantial Bitcoin amounts has created a stir in the market.

Analysts estimate that up to 99% of the $8.2 billion worth of Bitcoin being repaid could be sold, putting additional pressure on Bitcoin prices.

This anticipation has already led to a drop in Bitcoin’s value, with prices falling below $55,000 as creditors move $2.7 billion worth of Bitcoin from cold storage to a new wallet.

Ethereum’s Performance and ETF Developments

Ethereum is also in the spotlight with several key developments. Despite the broader market downturn, Ethereum’s ecosystem shows resilience.

The network saw a record number of daily active wallets in Q2 2024, driven partly by temporary airdrops. However, Ethereum’s price has been affected by fears of a Bitcoin market dump and declining institutional interest.

On the regulatory front, Galaxy Digital’s head of asset management expressed confidence that Ether ETFs will be approved soon, which could bolster Ethereum’s market performance. The approval of these ETFs is expected to attract significant inflows, although the initial impact may not match that of Bitcoin ETFs.

South Korea’s New Crypto Monitoring System

In regulatory news, South Korea has launched a continuous monitoring system for suspicious cryptocurrency transactions, set to go live in mid-July. This system aims to identify and curb abnormal transactions, enhancing the security and transparency of the crypto market in the country.

This move is part of broader regulatory efforts, including the upcoming Virtual Asset User Protection Act, which mandates stricter oversight of crypto exchanges.

UAE’s Zand Bank Crypto Services

Zand Bank has partnered with Taurus to offer secure and easy crypto services. Your digital assets are protected with top security measures, and you can now convert physical and digital assets into digital tokens.

This makes investing more flexible and cost-effective. Manage all your assets on one simple platform. With Zand Bank and Taurus, your investments are safer and more accessible than ever.

Bitget’s Fiat OTC Service

Bitget launched a fiat over-the-counter platform for block trades, initially supporting GBP, EUR, and USD, targeting institutional investors and professional traders with no maximum trade limit and instant settlement upon confirmation.

This new service supports major currencies, allowing users to conduct substantial transactions with ease.

The platform also employs advanced security measures to ensure that all transactions are safe and secure, providing users with a reliable and efficient trading experience.

Imperial College’s I3-Lab

Imperial College’s I3-Lab is dedicated to driving sustainable economic growth by integrating blockchain technology into various sectors. With a generous £1 million endowment from IOTA, the lab focuses on innovative applications and cutting-edge research.

Its goal is to enhance industry efficiency and sustainability, fostering advancements that can significantly impact diverse fields and contribute to long-term economic development.

These developments highlight the dynamic nature of the crypto market, with significant institutional involvement and technological advancements shaping the future landscape.

Furthermore, the latest updates reveal that the total volume of Ethereum DApps surged by 83%, although this growth is largely attributed to a single application dominating the network’s volume. This highlights the ongoing interest and activity within the Ethereum ecosystem, despite the overall market volatility.

Author: Mr.OxBull

Article Published: 6th July, 2024